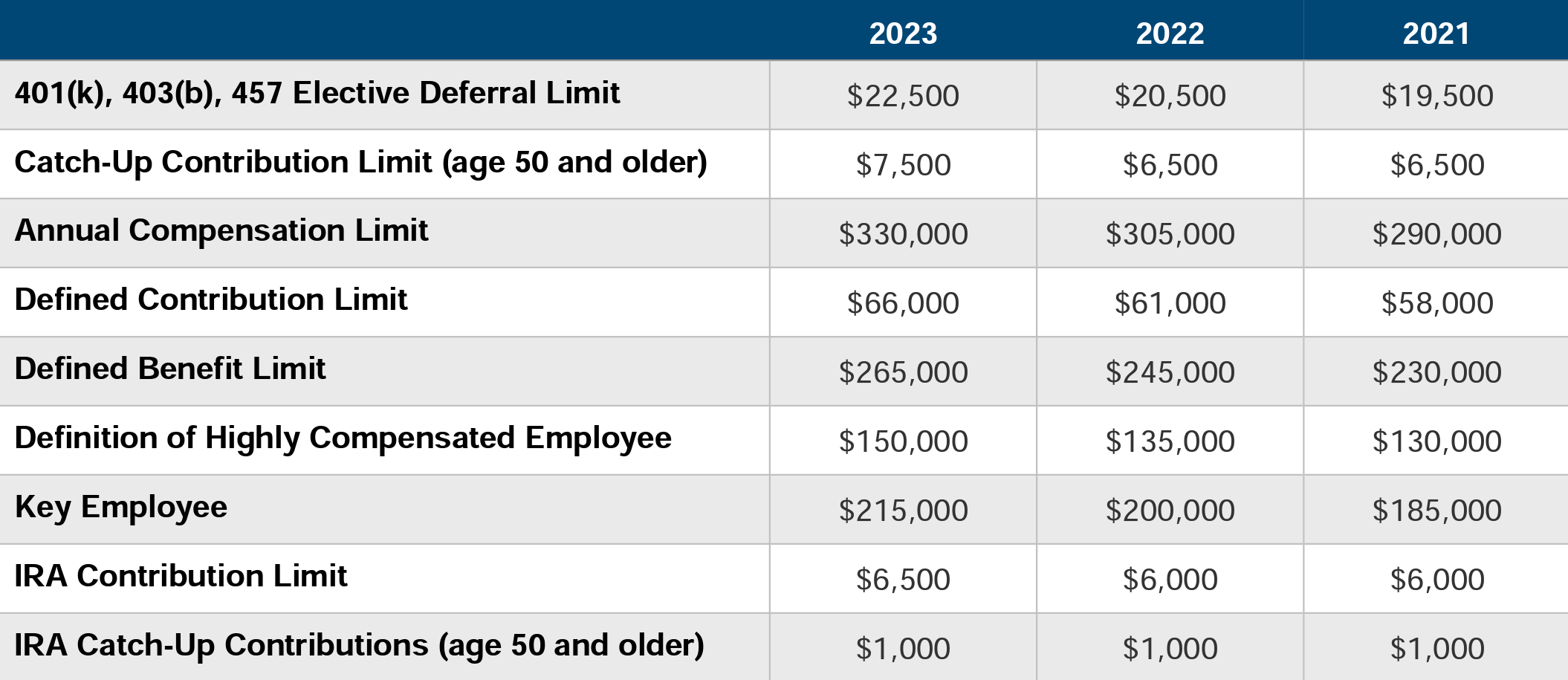

Highly Compensated 401k Limits 2025 - 2025 Roth 401k Limits Alice Brandice, It’s important to know the irs rules for 401(k). Both payroll administrators and employees should be aware of newly announced 401(k) match and contribution limits for your retirement plans. 2025 Hce Compensation Limit Nevsa Adrianne, The 401k/403b/457/tsp contribution limit is $22,500 in 2023. For example, in 2025, an employee.

2025 Roth 401k Limits Alice Brandice, It’s important to know the irs rules for 401(k). Both payroll administrators and employees should be aware of newly announced 401(k) match and contribution limits for your retirement plans.

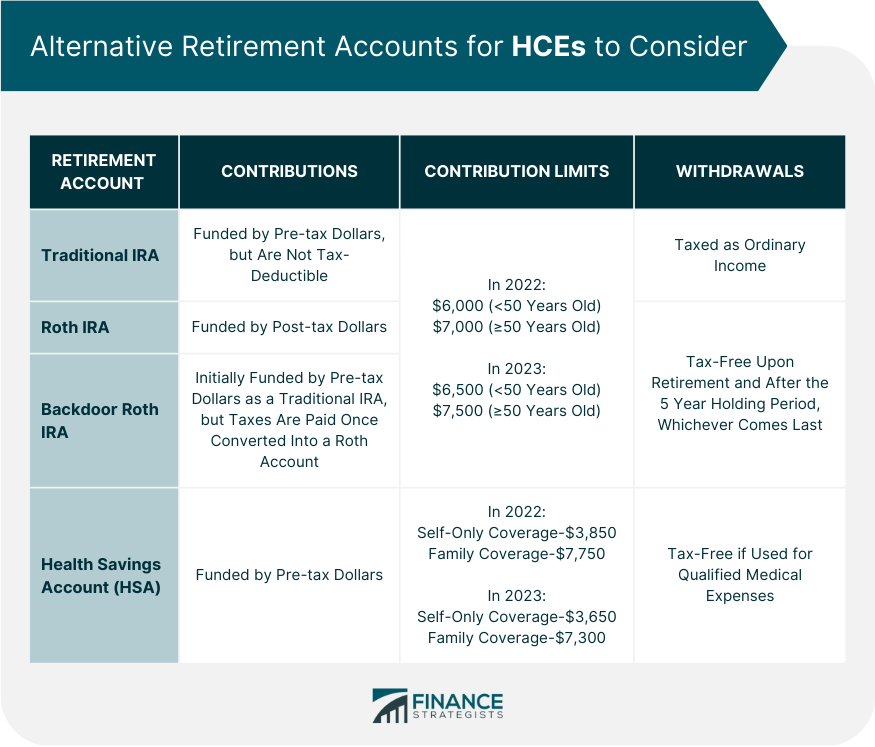

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, The irs defines a highly compensated, or “key,” employee according to the following criteria: 2025 limits and thresholds for qualified retirement plans.

2025 401k Limits Chart Tedda Ealasaid, 2025 highly compensated employee 401k misha tatiana, final thoughts on 401k limits for highly compensated employees. 401 (k) contribution limits for hces.

2025 Roth 401k Limits Moira Lilllie, Is an officer of the. Those 50 and older can contribute an additional $7,500.

401k 2025 Contribution Limit IRA 2025 Contribution Limit, Both payroll administrators and employees should be aware of newly announced 401(k) match and contribution limits for your retirement plans. Understand what an hce is and the irs rules these employees.

The irs has released new retirement plan contribution limits for 2025. 401 (k) contribution limits for hces.

What Is 2025 401k Limits Debbie Kendra, How to cash out a 401k when. For example, in 2025, an employee.

2025 Hce Compensation Limit Nevsa Adrianne, Plan participants can contribute up to $23,000 for 2025, which is up. Compliance testing for a 401 (k) retirement plan ensures the plan adheres to internal revenue service (irs) regulations, preventing.

2025 Highly Compensated Employee 401k Misha Tatiana, For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2023. Is an officer of the.

For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000.

Both payroll administrators and employees should be aware of newly announced 401(k) match and contribution limits for your retirement plans.

The roth 401(k) contribution limits for 2023 and 2025 are the same as the pretax limit for traditional 401(k) plans. Key details on employee contribution changes and.